What Documents You Need for FAFSA Application

FAFSA stands for Free Application for Federal Student Aid. It is the most important form that students in the United States fill out to get financial help for college university. This form helps the government decide how much aid you qualify for including grants loans and work-study programs.

Applying for FAFSA is completely free. The only thing you need to do is gather the right documents and fill out the application carefully. Whether you are applying for the first time or renewing your aid.

Main Documents Required

To complete your FAFSA application you need several important documents. These documents help verify your identity financial situation and academic plans. The exact documents you need may change slightly based on whether you are a dependent or independent student.

Here are the basic documents you must collect before you start filling out your FAFSA:

List of All FAFSA Documents Needed

- Your Social Security Number (SSN): This is required to verify your identity. If you don’t have one, and you’re not a U.S. citizen, you’ll need your Alien Registration Number.

- Your Federal Tax Returns (IRS 1040): FAFSA asks for your income information from the previous year. For example, for the 2025–26 application, you’ll need 2023 tax details.

- W-2 Forms and Records of Income; This includes income from all jobs or any other work you’ve done in that year.

- Records of Untaxed Income: If you receive child support, disability benefits, or veterans’ non-education benefits, those should be reported too.

- Bank Statements: Include both checking and savings account balances. Make sure to include only what’s necessary.

- Investment Records (If Any): If you or your parents have investments such as stocks, bonds, mutual funds, or real estate (not your home), these must be included.

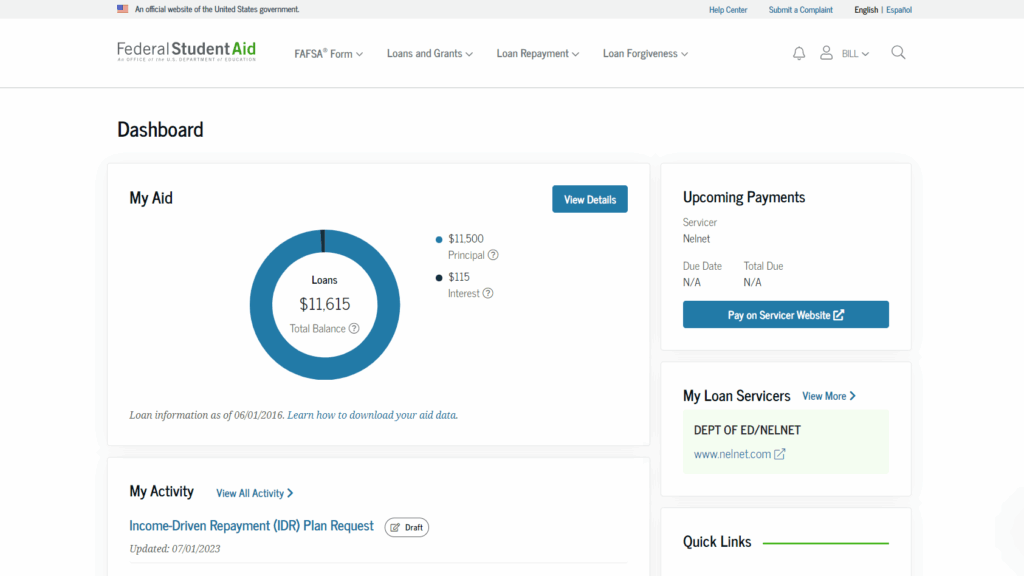

- FSA ID (Federal Student Aid ID): This is a username and password that lets you sign your FAFSA form electronically. Both the student and parent (if dependent) need their own FSA IDs.

- Your Driver’s License Number (If Available): Not required, but helpful in verifying identity.

- Parent Information (If You’re a Dependent Student): This includes their income, tax returns, W-2s, and other financial data.

- Your Email Address: FAFSA will send updates and important information through email, so use one you check often.

Income and Financial Info

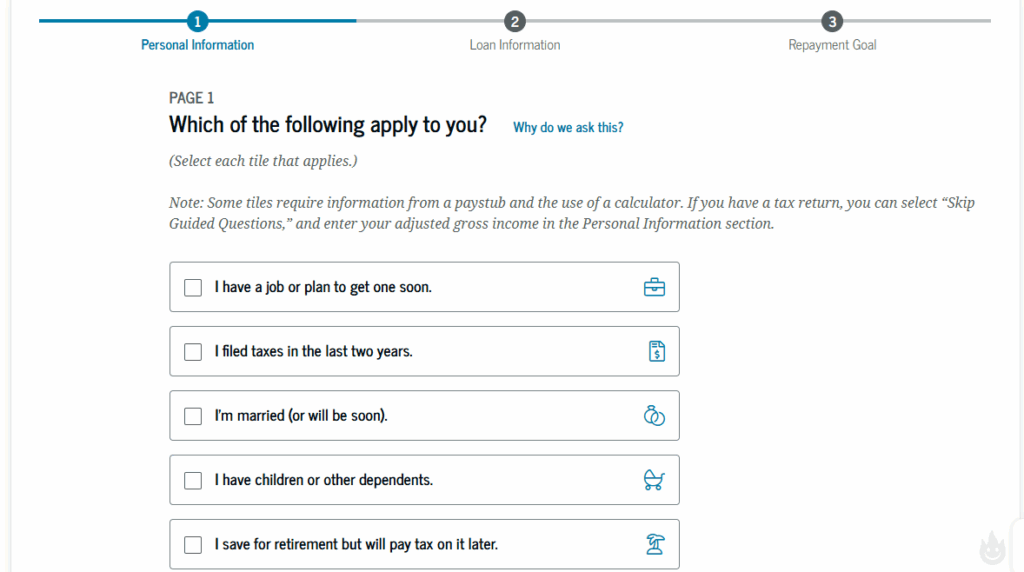

Understanding how income and financial records are used in FAFSA is very important. FAFSA uses a formula to calculate your Expected Family Contribution (EFC) based on your income and your parents’ income (if you’re a dependent).

Here’s what to include:

- Adjusted Gross Income (AGI) from your tax return

- Wages and tips from jobs

- Untaxed income such as child support received, interest income, and veterans’ benefits

- Any income earned outside the U.S. (if applicable)

You must be honest and accurate. Any mistakes or missing data can cause delays or even rejection of your financial aid.

Tip: You can use the IRS Data Retrieval Tool (DRT) inside the FAFSA form to directly import tax return info. This saves time and reduces errors.

Special Cases and Extra Documents

Some students may have unique situations that require different or additional documents. Here are a few common special cases:

1. If You’re Not a U.S. Citizen

You’ll need your Alien Registration Number or other proof of legal status. DACA students may fill out state aid forms instead.

2. If You’re an Independent Student

You do not need to provide parental information. You’ll need proof of independence like:

- Marriage certificate

- Military service documents

- Documentation of children you support

3. If Your Parents Are Divorced or Separated

Only the parent you live with most should provide their financial details. If they’ve remarried, their spouse’s info must be included too.

4. If You’re in Foster Care or Homeless

You’ll need a letter from a school official, shelter, or social worker confirming your status.

5. If You Have a Disability

You may need to provide medical documentation or proof of Social Security Disability benefits if applying for certain programs.

6. Victims of Natural Disasters or Job Loss

If your financial situation changed suddenly, you can submit a special circumstances appeal to your college with proof like:

- Layoff notice

- Natural disaster damage report

- Medical bills

How to Store and Organize FAFSA Documents

Keeping all your FAFSA documents safe and organized is key. Here’s how to do it:

Create a FAFSA Folder (Digital or Physical)

Include:

- Tax returns

- W-2s

- Bank statements

- Any letters or official notices

- Your FSA ID details

Keep Backups

Scan and save digital copies to a secure cloud service or an external USB. Always keep both hard and digital versions.

Mark Important Dates

Use a calendar to track FAFSA deadlines and reminders for updates or corrections.

Save Contact Info

Write down phone numbers or emails for FAFSA support, your school’s financial aid office, and any support counselors you work with.