How to Repay Your Federal Student Loans as a FAFSA Applicant

The Free Application for Federal Student Aid (FAFSA) helps students get financial aid for education, including federal student loans. These Federal Student Loans make it easier to pay for college, but they must be repaid after you finish school or stop studying full-time.

Basics of Federal Student Loan Repayment

Before we talk about repayment steps, let’s quickly cover the basics:

What Are Federal Student Loans?

Federal student loans are loans from the U.S. government to help students pay for school. Unlike private loans, they usually have lower interest rates and better repayment options.

Types of Federal Student Loans:

- Direct Subsidized Loans – Government pays the interest while you study.

- Direct Unsubsidized Loans – You are responsible for interest during all periods.

- PLUS Loans – Loans for graduate students or parents.

- Consolidation Loans – Combine multiple loans into one.

How to Repay Your Federal Student Loans Step by Step?

Repaying your Federal Student Loans is easier when you follow these simple steps:

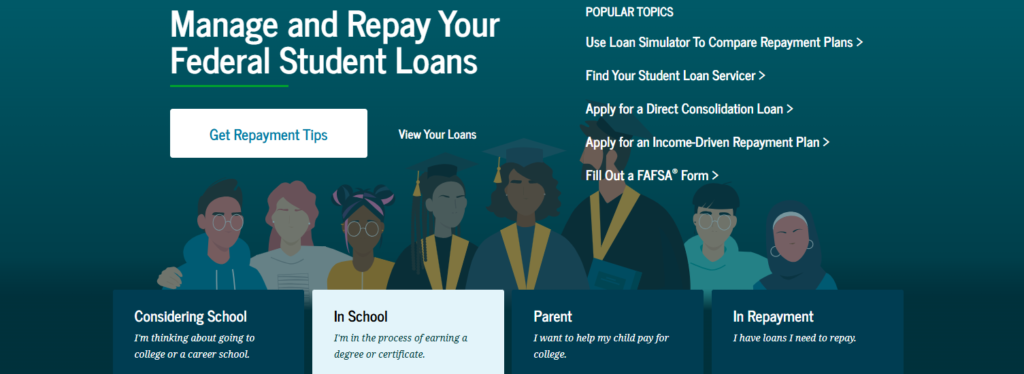

Log In to Your Loan Account

- Check your loan amount, interest rates, and servicer information.

- Visit studentaid.gov

- Use your FSA ID and password to access your loan details.

Know Your Loan Servicer

Your loan servicer is the company that handles your payments. They will send your bills and help you with repayment options. You can find their name in your studentaid.gov account.

Tip: Always keep your contact information updated with your loan servicer.

Choose a Repayment Plan

There are different repayment plans to fit your situation. We’ll explain them in the next section.

Set Up Your Payments

- Link your bank account to your loan servicer’s system.

- Set up AutoPay to ensure you never miss a payment (you might get a small interest rate discount).

Start Making Payments

- Pay on time each month.

- Consider making extra payments when possible to reduce your total interest.

Bonus Tip: If you face money problems, contact your loan servicer. They can help with deferment, forbearance, or changing your plan.

Different Federal Loan Repayment Plans Explained

The U.S. government offers several repayment plans. Choose one based on your income, loan amount, and future goals:

Standard Repayment Plan

- Best if you have stable income and want to finish fast.

- Fixed payments for 10 years.

- You pay less interest overall.

Graduated Repayment Plan

- Payments start small and increase every two years.

- Total repayment time is 10 years.

- Good if your income is expected to grow.

Extended Repayment Plan

- Payments can be fixed or graduated over 25 years.

- Lower monthly payments but more total interest.

- Available if you owe more than $30,000 in Federal Student Loans.

Income-Driven Repayment (IDR) Plans

These plans set your payments based on your income and family size. Great for those with low income or unstable jobs.

Popular IDR Plans:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

Benefits of IDR Plans:

- Lower monthly payments based on your income.

- Possible loan forgiveness after 20-25 years of payments.

- Affordable for new graduates starting their careers.

Choosing the Right Plan

Talk to your loan servicer or use the Loan Simulator tool at studentaid.gov to see which plan fits you best.

Repaying your federal student loans as a FAFSA applicant may feel overwhelming at first, but it’s manageable with the right steps and knowledge.

Visit Our Related Blogs for More Information About FAFSA